If you’re a C-Corporation registered in Delaware and operating in California, navigating the annual Delaware franchise tax can seem like a complex task. This guide aims to simplify the process, providing a clear understanding of the due dates, methodology, and the importance of foreign registration in California.

Delaware Franchise Tax Overview

Due Date

The annual franchise tax in Delaware is typically due by March 1st. It’s crucial to mark this date on your calendar to ensure timely compliance.

Calculation Methodology

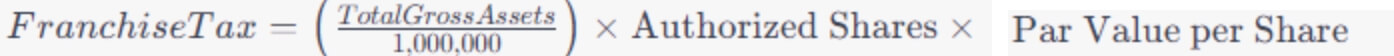

- The franchise tax is based on two methods: the Authorized Shares Method and the Assumed Par Value Capital Method.

- For most startups, the Assumed Par Value Capital Method is more straightforward. The tax is calculated using a formula that includes the number of authorized shares and gross assets in Delaware.

Steps to Calculate Delaware Franchise Tax Using Assumed Par Value Capital Method

Step 1: Gather Information

Collect the following details:

- Total gross assets as of the end of the corporation’s fiscal year.

- The total number of issued shares (both common and preferred).

Step 2: Use the Formula

The formula for the Assumed Par Value Capital Method is as follows:

Step 3: Calculate and Pay

Plug in the values and calculate the franchise tax. Ensure payment is made before the March 1st deadline to avoid penalties.

California Foreign Registration

Why Register in California?

If your Delaware C-Corporation is conducting business in California, it must register as a foreign entity. This ensures compliance with California state laws and provides your corporation with the legal authority to operate within the state.

Steps for California Foreign Registration

- Name Availability Check:

- Check if your corporation’s name is available for use in California.

- Prepare and File Application:

- Complete the Application to Register Foreign Corporation (Form S&DC-S/N).

- Pay the Fee:

- Submit the required filing fee along with the application.

- Compliance with Additional Requirements:

- Fulfill any additional requirements outlined by the California Secretary of State.

- Maintain Compliance:

- Stay informed about ongoing compliance obligations in California.

Conclusion

Navigating Delaware franchise tax and foreign registration in California may seem intricate, but breaking down the process into actionable steps can simplify the journey. By understanding the due dates, calculation methods, and the necessity of foreign registration, your C-Corporation can ensure smooth operations while remaining compliant with both Delaware and California regulations.