When should I start to prepare my taxes?

All Videos

When should I start to prepare my taxes?

What are common mistakes individuals make when filing their taxes?

What are common mistakes small businesses make when filing their taxes?

Preparing your taxes, the professional way, or the intelligent way in my opinion, is a year-round process. So, during the year, you’re gathering charitable receipts, or you’re doing your bookkeeping as a business, then you’re projecting out.

How do you think this tax year is going tocome, let’s say it’s June 30th and you get your June 30th pay stub, not alot is going to change. If you double that, then you have your whole year as an individual you can put that in the prior your software. You can go ahead and put that in a projection tool that you can find online or work with your professional. See where you are, what can you do now, especially when you’re self-employed, you might want to accelerate deductions or if it’s a low tax year, you might want to actually increase your income.

So preparing, taxes can be a year-round process. You’re in the past, you’re currently doing your business or working and you’re projecting out how is going to work out next year and while it’s great and nice to get your taxes done early professional tip especially when the bigger numbers are involved. It can be a great idea to file an extension, but get paid in for the current year, the current tax year meaning the last year’s tax here so that you have a little bit more time to think repair about what’s going on and what would be the absolute present moment, as well as behind you can see how things shape up then you might have some decisions, such as depreciation of assets or other technical decisions that having a little bit more time, down the road, it will actually serve you much better.

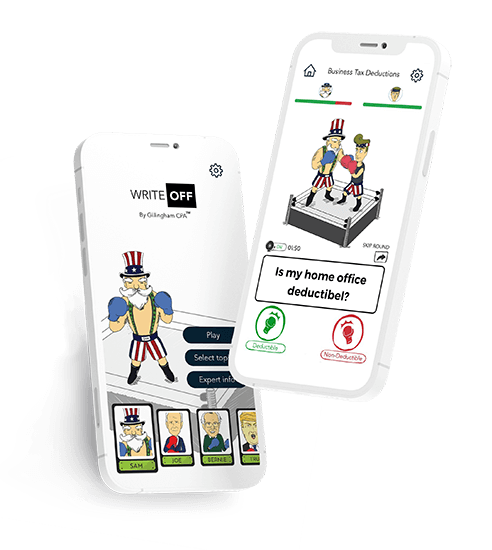

Write Off App

App for entrepreneurs to learn tax savings, structure correctly, & grow their business with an easy game.

A player chooses a character and plays each round against an opponent answering questions and learning on how to structure a business, pay less tax, and more along the way. It is a fun and interactive way to learn all you need fast!

About Us

Gillingham CPA is a San Francisco-based tax and accounting firm with a passion for helping clients grow their small businesses and navigating the tax waters. We specialize in consulting, boot-strapped startups, pre-series A ventures, and stock option -compensated employees. We take pride in providing services that go beyond just a tax return.

In addition to the general site, be sure to check out:

View All Videos