How can I be smarter with my money?

All Videos

How can I be smarter with my money?

What are common mistakes individuals make when filing their taxes?

What are common mistakes small businesses make when filing their taxes?

The context of taxes, an individual can be smarter. Typically, by pushing out taxes into the future, let’s take an example of Warren Buffett’s Berkshire Hathaway, he has shares in his company, that company is paying taxes and he’s just holding on to those shares. He’s not creating those gains and he’ll probably die with the majority of those shares, give it to charity or otherwise.

Pushing back the taxes to the future is generally a really good idea. So that’s where deductible 401(k) or retirement plans come in is taking the deductions while you can, and then perhaps kicking the tax can down the road and there’s different ways to do that, but for an individual, the 401(k) is a common one and also being smart tax-wise is to understand that low-income years can also be a great strategy to try and bring more income into those years.

So for example, if you’re making 100K at a job for three years and then you do your startup and you’re making zero, you’re going to want a mechanism to save taxes or push bone taxes and those prior years that could be a 401(k) and then accelerating income which you could do some IRA planning and those low tax years and it’s all really explained. You can definitely save a lot other. Also, the more tax efficient investments also on the individual side simply knowing what works for you as far as accumulating and saving money.

And that can take the form of sort of technical planning, but it can also be just tracking and a tracking software or again what works for Are you? And that could be just starving yourself from for money, putting it somewhere where you can’t get to it, whether it’s real tin can or a metaphorical one. So, get it away from you, put it to work, consider investing for the long long term because a lot of our economy is predicated on it. And in the long term, it’s worked out for many, many people, but that’s an investment advisory type of question. So, definitely do your homework on that.

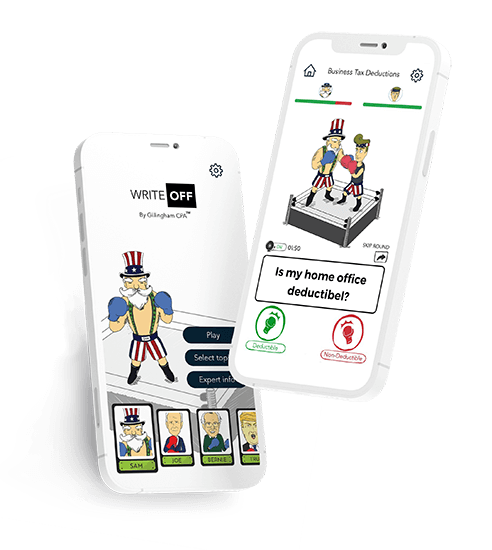

Write Off App

App for entrepreneurs to learn tax savings, structure correctly, & grow their business with an easy game.

A player chooses a character and plays each round against an opponent answering questions and learning on how to structure a business, pay less tax, and more along the way. It is a fun and interactive way to learn all you need fast!

About Us

Gillingham CPA is a San Francisco-based tax and accounting firm with a passion for helping clients grow their small businesses and navigating the tax waters. We specialize in consulting, boot-strapped startups, pre-series A ventures, and stock option -compensated employees. We take pride in providing services that go beyond just a tax return.

In addition to the general site, be sure to check out:

View All Videos