GILLINGHAM CPA

EXTENSION

In this guide, we’ll break down the key aspects of tax deadlines and extension payments, providing clarity and actionable strategies to help you stay on top of your finances.

Table of Contents

Extension in General

Simply put, generally speaking, taxes are due on April 15th or much sooner. So as a general rule, the IRS and California or other states require you to be paid in as the years go along. Now sometimes you have an exception to pay later, which is covered on our website, but let’s just talk about extensions in general right now.

Introduction to Extensions

All taxes for the prior year are due 4/15 or sometimes sooner. If the return is not complete around 4/1 we recommend extending so we have more time to optimize the returns and reporting everything properly. Taxes are still due 4/15 or sooner, but we then have until 10/15 to perform the actual filing.

Our Extension Payment Mantra

When paying in extension payments we round up and try to cover some of the current year. If you would like to pay in less and risk some penalty, that is fine as well. We just like penalty avoidance, even if small penalties, as this prevents further research required, explanations, tax notices in the mail, and generally poor uses of energy as well as a compliance budget.

Rounding Up

When extension payments are due, the returns are still drafts. Depending on the uncertainty and a client’s budget, we will round recommended extension payments up. For example if tax due is $7,999, we might go ahead and recommend a $10,000 payment if no current year tax is due.

Paying More in Case Q1 Payments are Due

If there is also tax due for the current year we can then increase the payment further to help cover that. The idea is to have a refund that we may later apply to the current tax year or request that monty back if it is not needed to be made with the IRS or state.

Why not just pay exact amounts?

Extension payments are based on non-finalized numbers. Paying in more is conservative for penalty prevention. In summary, rounding up is safer and faster. Any over payments may be applied or refunded. Foregone opportunity cost on rounding up (some missed interest in a savings account for example) is not material to the cost involved of spending more time with the projection work.

Making Extension Payments and Applied Refunds

How to make extension payments

How to make an extension payment fed

How to make an extension payment CA

- Taxes are generally due during the year.

- If an exception is made to pay later, then taxes are due 4/15.

- Penalty rules and exceptions can be explored here.

- Therefore if there is tax due for the past calendar year we will advise 4/15 payments.

- As of 4/15 any taxes due for quarter 1 are also due.

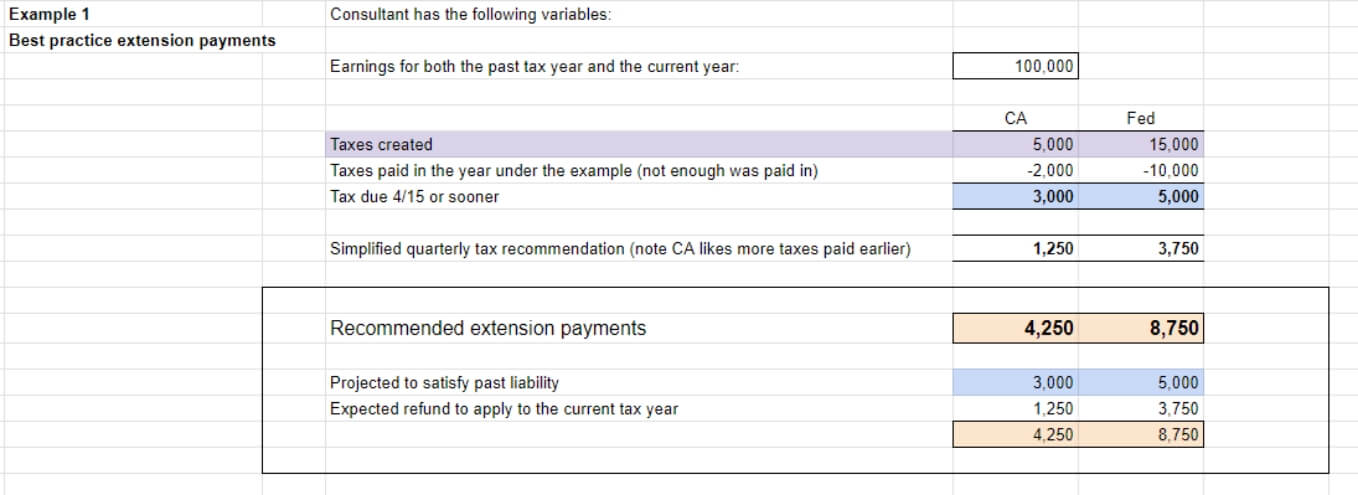

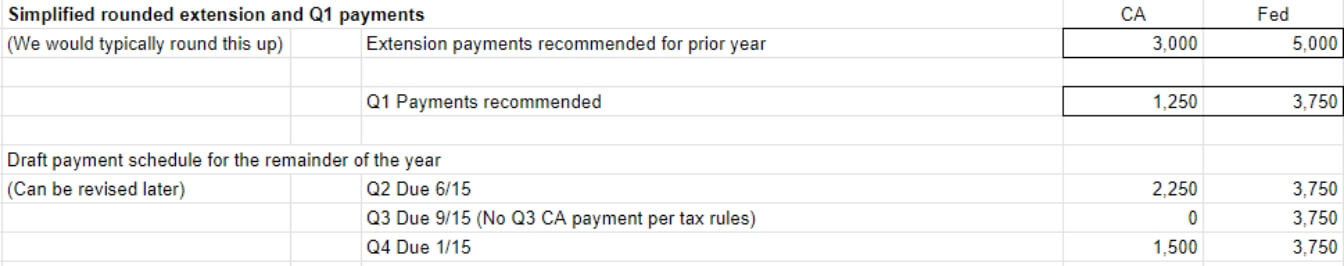

Best Practice to Satisfy Both the Prior Year and Q1 at the Same Time

As a best practice we may advise extension payments that not only cover the prior year, but also the first quarter of the current year. Extension payments would therefore be made so that a refund is produced can be applied to cover any Q1 payment requirement.

Why Do This?

Occasionally there are unexpected changes to tax documents or figures at the extension filing. Paying in with the anticipation of covering Q1 gets more money on deposit for the past tax year, just in case more tax is due. Should there be more refund than expected or the current tax year is less than expected, then a refund may be requested.

Why Not Just Do Quarterly Estimates Separately?

There is no financial disadvantage to paying in to the prior tax year. If payments are made separately and significant changes happen, then there is less flexibility for penalty mitigation or request of refunds when making payments across different tax years.

When Do We Bother to Make These Combo Prior Year and Q1 Extension Payments?

If owing for Q1 and possibly for the prior year, might as well pay in under an extension. The larger the accrued tax liability, uncertainty in the finality of the projection, and the longer the length the return is extended – the more it is recommended to make significant extension payments to cover the prior year and Q1 tax liability. Becuase Q2 is also due 6/15 (just 60 days or so after the extension payment deadline) it is a good idea to pay in even more so that some or all of Q2 is covered. This helps out when work is in draft form and the client is trying to limit their time and payment frequency as much as possible.

When Does a Combined Extension + Q1 Payment Not Make Sense?

- Income and payment amounts are generally not material to the time involved.

- Explaining the concept and following through is more costly than the benefit.

- Client has high borrowing costs or significant cash needs