Gillingham CPA Menu of Services and Standard Cost

Gillingham CPA menu of specific services as a part of regular prep fees or a separate advisory project. General fee ranges are covered in our Cost Page for taxes and Monthly Bookkeeping. For even more info on pricing we have our billing policy posted as well.

General Fee Range Estimates

Occasionally fee ranges can be higher or lower depending on the events, amounts, ongoing communication, complexity, and advisory. These are examples of services that tend to be an additional fee and scope to standard budgeted tax work.

Standard Individual

Minor consulting income and expense reporting

Pre rental property income, expense, and optimization

Home or rental property sale

Move from CA taxation and multi-year state tax strategy

Foreign tax complication add-on for existing clients

Minimum division of tax, per calculation, no accounting for capital gains / losses, AKA, “Which partner owes what tax”

Division of tax calculation, per calculation, capital gains / losses accounting and tracking

Typical discussion items where we can refer out or make a custom work item

Home purchase, rental property purchase, tax diversification, entity tax strategy, household finance

Rapid assessment and referral typically to an outside attorney

Trust and estate, entity formation, insurance, investments, lending

Equity Comp RSU

Withholding true-ups or estimated tax calculations

Equity Comp ISO

Projections and tax payment instruction for large stock sale events common shares or acquired (acq) via RSU and ESPP

Projections and tax payment instruction for large stock sale events common shares or acq via ISO

Initial exercise and hold AMT calculation, explanation, documentation, Q&A, 1 to 2 meetings, general ongoing strategy

Exercise and hold AMT calculations with advisory

Exercise and hold AMT calculations with advisory combined with non-qualified ISO disposition and possible ISO acquired LT shares with AMT adjustment

Bookkeeping Services and Tax Support (For monthly services please see this page)

Collaborate with client using Excel to prepare an optimized tax return ready profit and loss

Perform year-end close with client provided data with minor fixes in Quickbooks

Perform year-end close with client provided data with major fixes in Quickbooks

Perform year-end close with client provided data with inventory and cost accounting fixes in Quickbooks

Small Business

Tax optimized formation with tax entity analysis

Business sale

Startup Business

Manufacturing

Outlier projects, collaborations, or refer out to subject matter experts

‘Catch-up projects, multi state & foreign compliance, merger and acquisition, navigation of major charitable investment, referrals to other CPA experts in the fields of R&D, trust & estate, permanent out of country cross-boarder moves, Puerto Rico specific moves, LLC exits, annual ongoing comp excess of $5 Mil.

Minimum Scope

$500

$500

$500

$500

$750

$250

$750

$500

$750

$400

$500

$750

$1,000

$750

$1,000

$750

$750

$1,250

$750

$3,000

High Dollar Amount, Complex, Multivariable, Significant Impact

$1,500

$750

$1,250

$1,250

$3,000

$500

$1,500

$1,500

$3,000

$1,250

$1,000

$1,250

$2,000

$1,250

$2,000

$1,500

$2,000

$3,000

$1,750

$10,000

Minimum Scope | High Dollar Amount, Complex, Multivariable, Significant Impact | |

|---|---|---|

Standard Individual | ||

Minor consulting income and expense reporting | $500 | $1,500 |

Per rental property income, expense, and optimization | $500 | $750 |

Home or rental property sale | $500 | $1,250 |

Move from CA taxation and multi-year state tax strategy | $500 | $1,250 |

Foreign tax complication add-on for existing clients | $750 | $3,000 |

Minimum division of tax, per calculation, no accounting for capital gains / losses, AKA, “Which partner owes what tax” | $250 | $500 |

Division of tax calculation, per calculation, capital gains / losses accounting and tracking | $750 | $1,500 |

Typical discussion items where we can refer out or make a custom work item | ||

Home purchase, rental property purchase, tax diversification, entity tax strategy, household finance | $500 | $1,500 |

Rapid assessment and referral typically to an outside attorney | ||

Trust and estate, entity formation, insurance, investments, lending | $750 | $3,000 |

Equity Comp RSU | ||

Witholding true-ups or estimated tax calculations | $400 | $1,250 |

Equity Comp ISO | ||

Projections and tax payment instruction for large stock sale events common shares or acquired (acq) via RSU and ESPP | $500 | $1,000 |

Projections and tax payment instruction for large stock sale events common shares or acq via ISO | $750 | $1,250 |

Initial exercise and hold AMT calculation, explanation, documentation, Q&A, 1 to 2 meetings, general ongoing strategy | $1,000 | $2,000 |

Exercise and hold AMT calculations with advisory | $750 | $1,250 |

Exercise and hold AMT calculations with advisory combined with non-qualified ISO disposition and possible ISO acquired LT shares with AMT adjustment | $1,000 | $2,000 |

Bookkeeping Services and Tax Support (For monthly services please see this page) | ||

Collaborate with client using Excel to prepare an optimized tax return ready profit and loss | $750 | $1,500 |

Perform year-end close with client provided data with minor fixes in Quickbooks | $750 | $2,000 |

Perform year-end close with client provided data with major fixes in Quickbooks | $1,250 | $3,000 |

Perform year-end close with client provided data with inventory and cost accounting fixes in Quickbooks | $750 | $1,750 |

Small Business | ||

Tax optimized formation with tax entity analysis | ||

Business sale | ||

Startup Business | ||

Manufacturing | ||

Outlier projects, collaborations, or refer out to subject matter experts | ||

‘Catch-up projects, multi state & foreign compliance, merger and acquisition, navigation of major charitable investment, referrals to other CPA experts in the fields of R&D, trust & estate, permanent out of country cross-boarder moves, Puerto Rico specific moves, LLC exits, annual ongoing comp excess of $5 Mil. | $3,000 | $10,000 |

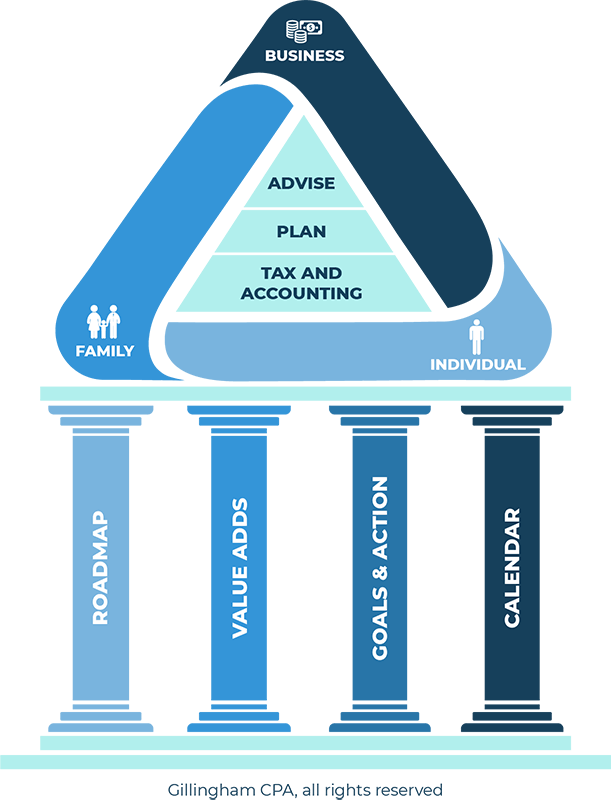

How Gillingham CPA Can Help You

Gillingham CPA is a boutique tax, bookkeeping, and advisory firm. We specialize in the area of small business, seed stage startups, and equity compensated (tech) employees.

We are a small team and plan on staying that way. With over ten years in business we have plenty of clients that have been with us for the entire stretch. We feel that consistency makes the process easier and more impactful on everyone. Since we bill mostly based on time, we are able to adjust our scope and billing as your financial needs change.

Value Added

Any other questions? We are here to help

Gillingham CPA aims for accuracy and transparency in how our service works. If anything remains unclear or if you have a question not covered on this page, please send us a message. We will be happy to get you the answer you need.