Question: Dear G.CPA, my fiancé and I launched an internet business early this year and it has been an outstanding success with over $50,000 a month income. What should we be doing?

Oh and a few other points provided:

-We are currently not married, but could marry early if recommended

-Basically the business is owned by both of us 50% / 50%

-We are open to working anywhere in the world and moving from CA as a lifestyle choice

Disclaimer – this is not tax or legal advice and is strictly educational. The general idea behind this is to convey some of the things a very new business, with income, might consider.

Dear Potential Client,

Would you like to trade businesses? Just joking, kinda, “haha.” First and foremost, congrats on your new endeavor and compliments for reaching out before the year closes. Starting early allows us the time to perform accounting and entity foundation so that we may then assist in more of an advisory foundation.

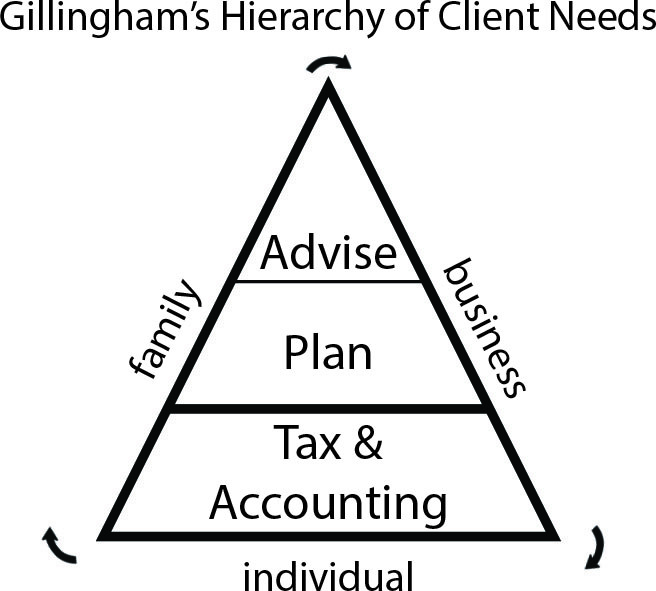

As a general model of organization, we will use Gillingham’s Hierarchy of Client needs as a foundation for our strategic approach. In general order, allow me to list some important points that come to mind to build from the bottom in order: Accounting & Tax, Planning, and then Advising.

Accounting Foundation

Goals: Up to date, accurate, simple, useful, affordable books

Getting there:

-Establish a separate business bank account and credit card

-Discuss best practices for keeping receipts and organizing info

-For past transactions, download to CSV (excel) format so we can categorize into proper categories

-Discuss how business is funded and what type of other out of pocket assets and expenses need to be captured

-The individual transactions or sum of other accounting will then upload to, likely, Quickbooks online

-Have one or two in-person sessions for the Quickbooks data gathering to teach you the basics

-After learning the basics we can decide how much work you want us to perform or not perform

Tax Foundation

Goals: Determining estimated payments requirements (when and how much to pay)

Getting there:

-Use current accounting and projection figures to determine when and how much tax to pay

-Get prior tax return for key information

-Get prior tax related information documented in a concise way, such as existing 401Ks – IRAs – retirement plans, any other background on income sources (miscellaneous stock holdings), real estate holdings

-Get background on any past, present, or future possible foreign holdings

Planning

Goals: Making accurate and timely estimated tax payments to avoid penalty and fees, determine best time to pay CA taxes, have systems in place

Getting there:

-Using accounting to create a projected tax return and optimize when to pay the CA payment

-Discuss any income acceleration or deceleration strategies, such as large needed purchases where the deduction may be accelerated

Advising

Goals: Performing actions prior to year-end designed with the end goal of lowering taxes on average within a short or very long-term period. Structure the business so that owners receive maximum cost v. tax savings benefit while having a legal operating entity that reflects the intent of the business owners (this involves an attorney).

Getting there:

-Employ proper individual of business retirement accounts

-Analyze what business entity options there are by calculating and weighing the cost, versus benefit, of the various possible entities

-Understand future general goals of the business and lifestyle desires of the business owners

-Future goals also is important to determining entity choice, aka, a lifestyle business versus an empire

-Consider out of state or out of country living desires

-Future lifestyle and income goals also may impact utilization of the type of retirement account and the amounts contributed

-Discussing larger family financial structure can also help determine strategy and general risks that a household may be taking

-Current asset pool and holdings may also have some impact on tax strategy

-Optimize accounting so that business owners may use for their own growth and goals – not just for a tax return

-Take a look to see how the hierarchical steps of Tax & Accounting, Planning, and Advising fits within the family plan (possible marriage), any planning for kids, how this impacts the individual owners

In Conclusion

Small businesses, like humans, are dynamic are rarely fit into neat service boxes with tidy fixed fee offerings. While this article may serve as a starting checklist of points and aspirational goals, the roadmap of how this is accomplished is conspicuously absent. This is the secret sauce, but the secret to the sauce is that, one sauce does not fit all. So now that we are semantically satiated – let’s get to the point. Need identification checklists help to get organized, but the final decision making is based on so much data gathering and variables it is difficult to synthesize in a spreadsheet and statistically weight the outcome for maximum client benefit, because of unknown, human, variables. So let’s have a human conversation and use our experience at Gillingham CPA to set your foundation, plan, advise, and get the action items you desire for both the short and long term.

And the marriage thing? I like to say that outside of forcing a child into the world, that forcing marriage too soon may just not be worth it. However, generally speaking, with joint filings – generally – there is an overall tax savings versus filing as individuals. Now… in your case, where your earned income will be nearly identical and in excess of $100,000 year, the two single filings cumulatively will produce similar results as the married filing joint return. Now there is convenience to combining all income on one return, but do we want to marry for convenience? A question like that is far outside the realm of our billable rates. So let’s plan for it, but in all likelihood, no major rush.

Thanks for reading,

Any questions, please email me, john at GillinghamCPA dot com

J

Want more? Checkout the iPhone and Android apps.