Value Added

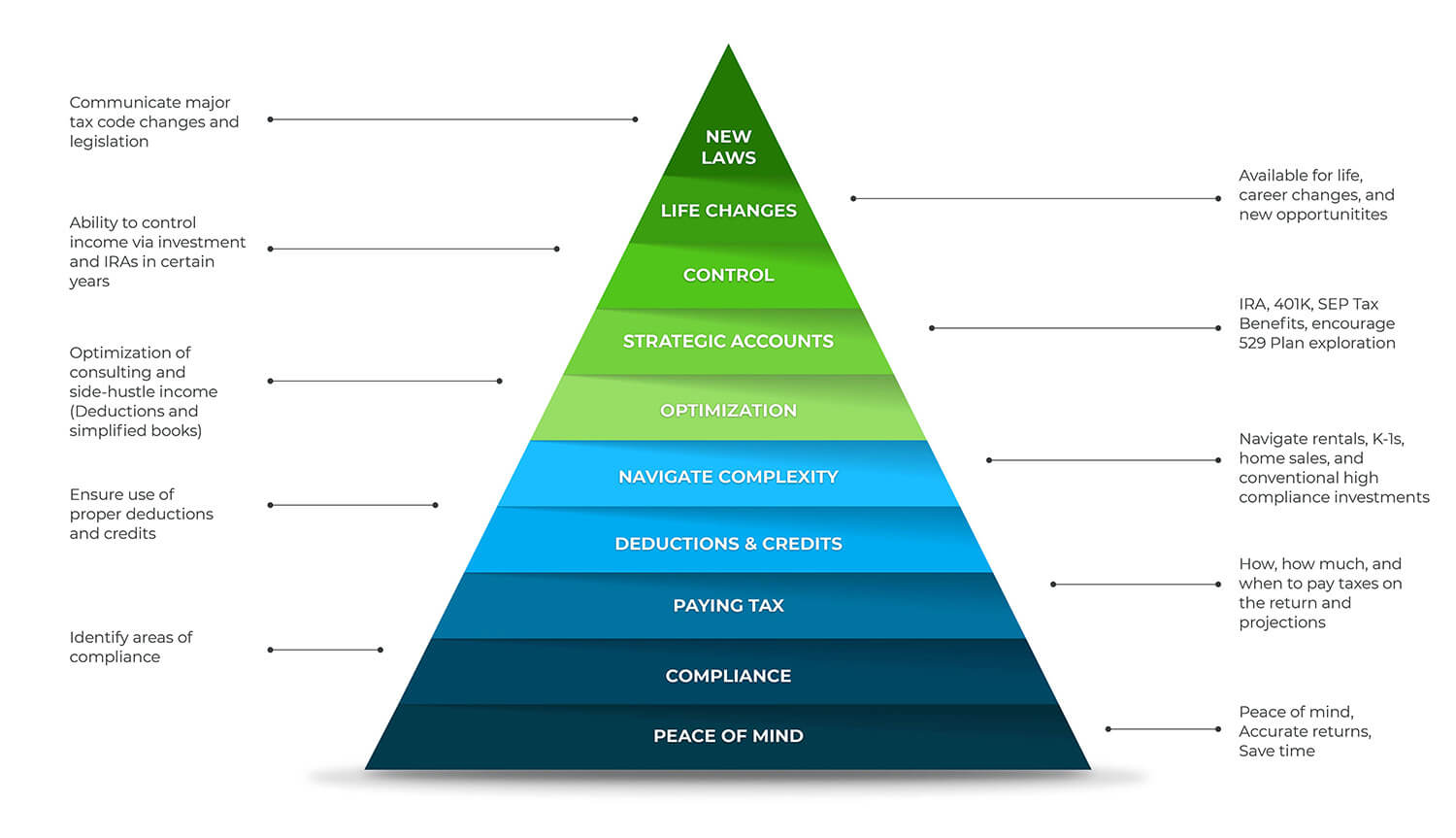

Gillingham’s Hierarchy of Client Needs

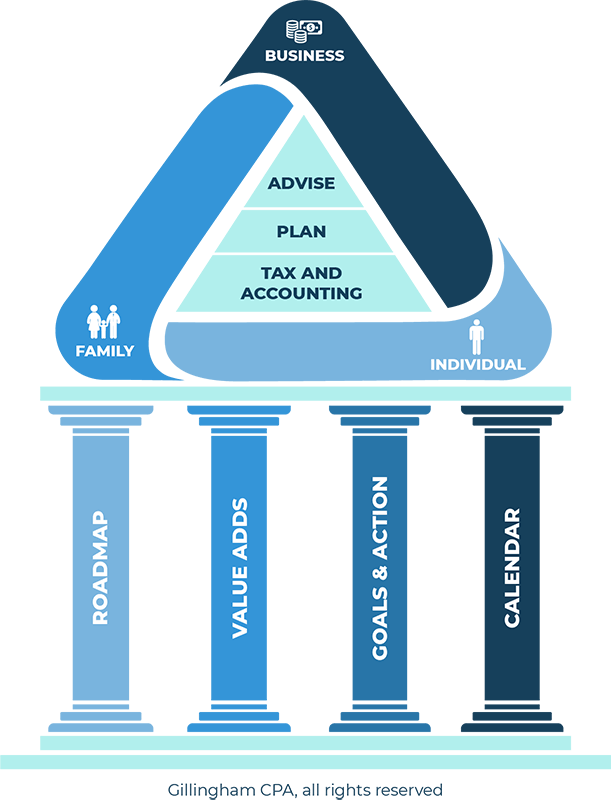

Maslow’s Hierarchy defines the relationship of human needs from the most basic: food and shelter, to the most advanced: self actualization. Maslow, as well as contemporary visionaries such as Chip Conley, have applied the hierarchy to business. Drawing from their inspiration, I have created the Client Hierarchy to represent how a CPA firm should be serving your most basic and advanced needs. The hierarchy from bottom to top, begins at tax and accounting, moves to planning, and then advising. Surrounding the hierarchy are the most common entities that should be considered as interdependent -the individual, family, and business – all related.

The foundation of my hierarchy and your needs will be tax and accounting. This foundation must be performed accurately and timely. Communication on both sides is essential so that we can understand your unique situation. Anyone can “do your taxes,” but the value of my ideal firm, is to achieve peace of mind by doing things properly (integrity) and getting to planning and advising. This journey (not a destination unless you just died (ironic comment and uncommon parenthesis)) is long-term and requires us both to do our job. The more organized and efficient we can be at accomplishing your basic needs, the more time we have available to ascend the hierarchy together. And like all worthwhile climbs, it is gonna take work and has a cost (figure about 50K to climb Mount Everest, so we are a bargain). Tax and accounting generally involves looking back, while planning is looking into the future.

After understanding your needs and completing your basic work, we begin to plan. Basic planning involves paying proper estimated personal and business taxes. Even if there are no estimates required; it is important have enough savings for taxes due, possible retirement (aka strategic) accounts, or expansion plans. Certain purchases made during the year can sometimes provide tax credits or deductions that are more than normally allowed. Retirement accounts can also be an excellent way to help you maximize tax benefits in low or high income years (think… what is income smoothing?).

Without planning, most of these strategies cannot be implemented after the tax year is over. Translation: “See” us before the “current” tax year ends. Advising is our premium value add. At the top of the hierarchy, quality advice can rarely be achieved without first having proper tax, accounting, and planning in place. Some of the best advising starts with preempting the unspoken needs of a client relationship. Successful people are generally busy and do not closely following the tax law, let alone the detail of their financial affairs. Advising integrates tax compliance, accounting, planning, and communication into the individual, family, and business affairs of YOU. Viewing a client relationship in terms of all of these variables allows US to communicate and propose solutions that are relevant, valuable, and viable.

Together we achieve our own “Client Actualization” when we complete the pyramid and integrate family, business, and personal matters into your financial decision making. Perhaps the end goal is simple? Mo’ money (tax strategy when we can) and Mo’ peace of mind (integrity, systems, compliance). The best way we can do “this” is to start fulfilling your more basic needs and communicate as much as possible. So please contact us. A greater understanding of you, your family, and business – or work (got stock options?) allows me to go above and beyond simply getting your stuff done. This is where we thrive and can provide lasting value in our long lasting relationship.

To see some of the things that make a strong client relationship, see our Fit and Framework pages.

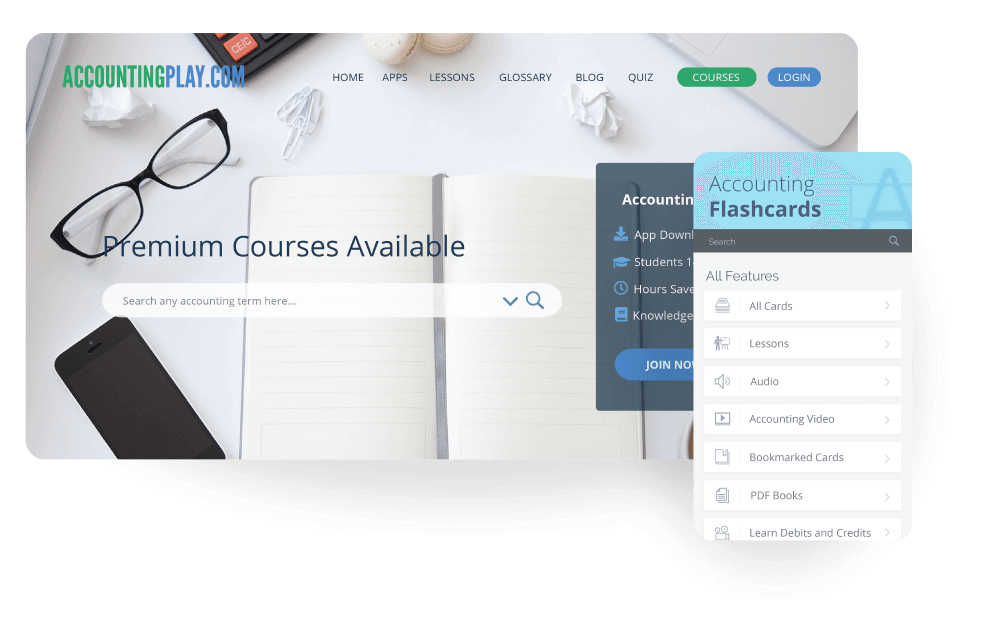

Check Out Our Educational Company: Accounting Play

Accounting Play makes the world of accounting and finance understandable and accessible. Checkout our membership site, Tax Fight! App, Accounting Flashcards iOS | Android and more

Lessons

Online lessons are free and cover accounting fundamentals, financial ratios and analysis, and tax basics. Most include audio narration and video.

Glossary A-Z

See the creative and at times bizarre way we have illustrated accounting.

Quiz

Brush up on your knowledge and reinforce important concepts at AccountingPlay.com. Also available as the Accounting Quiz App.

Premium Courses

Courses, downloads, academic papers, and the Accounting Play e-book library are available.

Accounting Apps

Learn accounting with AccountingPlay Apps. Choose, when, where and what to learn – Just Search “Accounting” in the App Store.

Blog & Podcast

Learn financial accounting with Accounting Play, by John Gillingham CPA.

Learn Accounting With Apps

Inspired by Gillingham’s tenure helping small businesses and students in the wild world of Accounting and Taxation.

Downloads

See below for some templates

Download free IRS penalty abatement letter template (Disclaimer: For educational purposes only. Seek professional attorney or Certified Public Accountant. No guarantees provided. Use at your own risk)

Federal abatement letter template, educational purposes only

Business Template Income and Expenses, Excel

Please see the following to help organize your rental expenses

1 Property, 1 Year

1 Property, Multiple Years

Multiple Properties

Please see the following to help synthesize the data (putting in the spreadsheet and emailing back)

Profit and Loss, General

Profit and Loss, No Inventory

Profit and Loss, Software Dev or Research and Development Related

Actual vehicle expense. Actual expense can be a great option to consider for over 50% business vehicles – especially with very heavy SUV / Sprinter van type vehicles which can produce more than average depreciation deductions (we can discuss). Most clients use standard vehicle expense which is very generally around “50 cents per business mile.” (Actual per mile can vary each tax year). In this case we just need to know the vehicle name, total miles driven in the entire year, and then the business miles (not including any commute). Economy / fuel efficient cars make this a great choice.

If you are using more than one vehicle

Please see here for the 2017 taxes paid template. This is a huge help when preparing your return. Please also update your file for any confirms and reference this document in the Excel file. Thanks!