Humble Client Receives $12,152,014 IRS Tax Bill

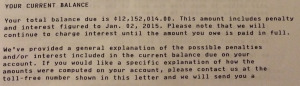

December 2014, a trusted client received a $12,152,014 IRS Tax Bill from the IRS, after we got a substantial amount of fees and penalties waived from prior tax years. Mr. Tech Client gave me permission to write about this ridiculously bizarre notice that he received. Mr. Tech, or T for short, was getting caught up on past taxes, making about 100K a year. So where did the 12mil tax bill come from?

Download free IRS penalty abatement letter template here (Disclaimer: For educational purposes only. Seek professional attorney or Certified Public Accountant. No guarantees provided. Use at your own risk).

I like to know my clients and T is an entrepreneur, options trader, and investor, so did he earn some 30+ mil or so amount of money that he forgot about? When I asked T, he jokingly replied that, “Maybe he won a ton of money in Vegas, spent it all, and then forgot about it. Yes T, yes, a plausible scenario visa-vi the movie “The Hangover” in which the characters wake to a gigantic mess after a long night.

Moments later after thinking of Las Vegas table limits and the short amount of time required to earn the 30+ mil we concluded that did not happen. So what did? The IRS computer system is known to generate outlandish tax bills when active stock traders have massive sales proceeds. When this occurs, the investor needs to also report the basis of his or her investments to calculate the taxable portion of the gain. However, this was not the case, as we already had all of the IRS transcript information.

And so I called the IRS, twice. Two hours later the Service (as they refer to themselves) concluded, that in fact T actually owed around 3k. As for the 12mil tax bill, they had record of the notice being sent, but could not open the letter due to the hierarchical and, yes, bureaucratic organization. “Must have been some kind of computer glitch” was the response I got. A “glitch” what is that in the year 2015?

I re-learned several things regarding this very, very, strange error:

- Remain calm when receiving correspondence from the IRS, it is often computer generated and contains errors

- The IRS can waive certain penalties, but you must ask nicely and early

- The IRS is actually quite cordial to deal with generally, but it takes an inordinate amount of time

- File extensions, file early, and do not fall behind… and this bizarre scenario would not have occurred

- Costs of late filing are compounded with interest, several different penalties, and the significant hours added for your San Francisco CPA bill to sort out the mess

- If dealing with the IRS, get a power of attorney signed early, as it takes significant time – even five business days or more before a qualified tax preparer can find transcripts (record of tax reporting)

- Finally, there is a new IRS feature which allows taxpayers themselves to pull an online record of tax documents filed in their tax ID number.

T was calm during the entire situation, thanks T! But I lamented the amount of time and mutual effort to work out the situation. Tax debt is like a super-powered credit card with several different types of interest. And unlike a credit card, debt is almost never forgiven with the IRS even if there is a bankruptcy. For my business owner and consultants, file your returns on time.

Other resources from John Gillingham:

Learn Accounting: https://accountingplay.com/

Get the App: Lessons, Audio, and Illustrated Accounting Flashcards for iOS on Android

Get the App: Learn Accounting Debits and Credits with the game on iOS

My Innovative Accounting Books: Amazon Kindle