Business - CA Corporation

Completed Return

Important

Please ensure you print the last page of the completed form or the payment confirmation page and upload it to your shared folder. Emailed confirmations do not always contain enough information.

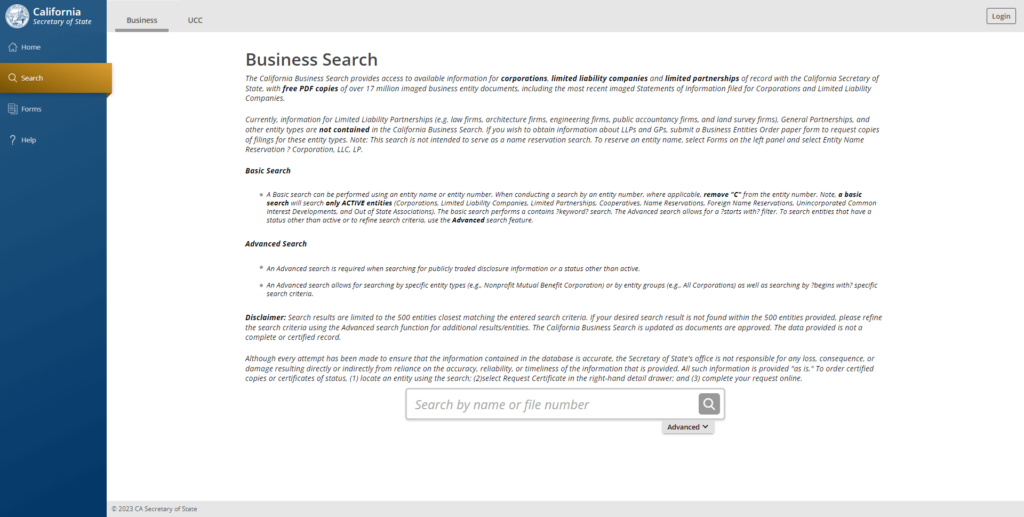

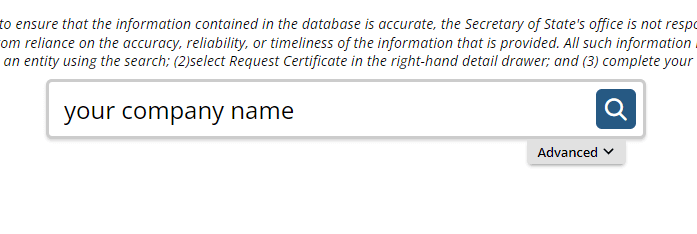

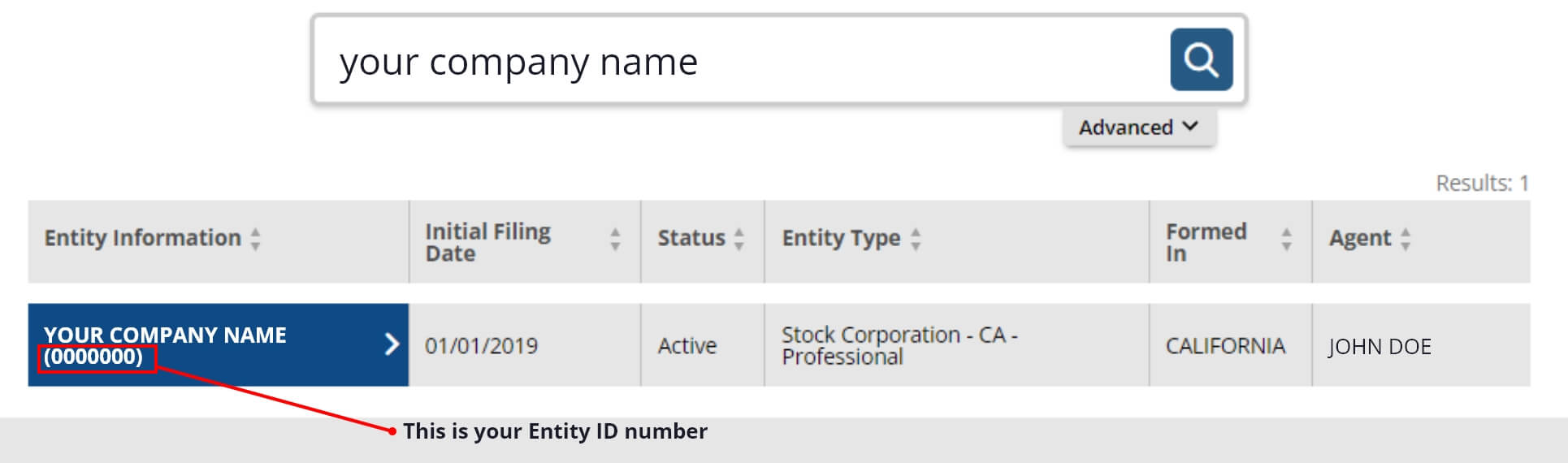

1. Search by your company entity ID number (You can skip this step and go to Step 3 if you already know it)

Go to the California Secretary of State website using this link https://bizfileonline.

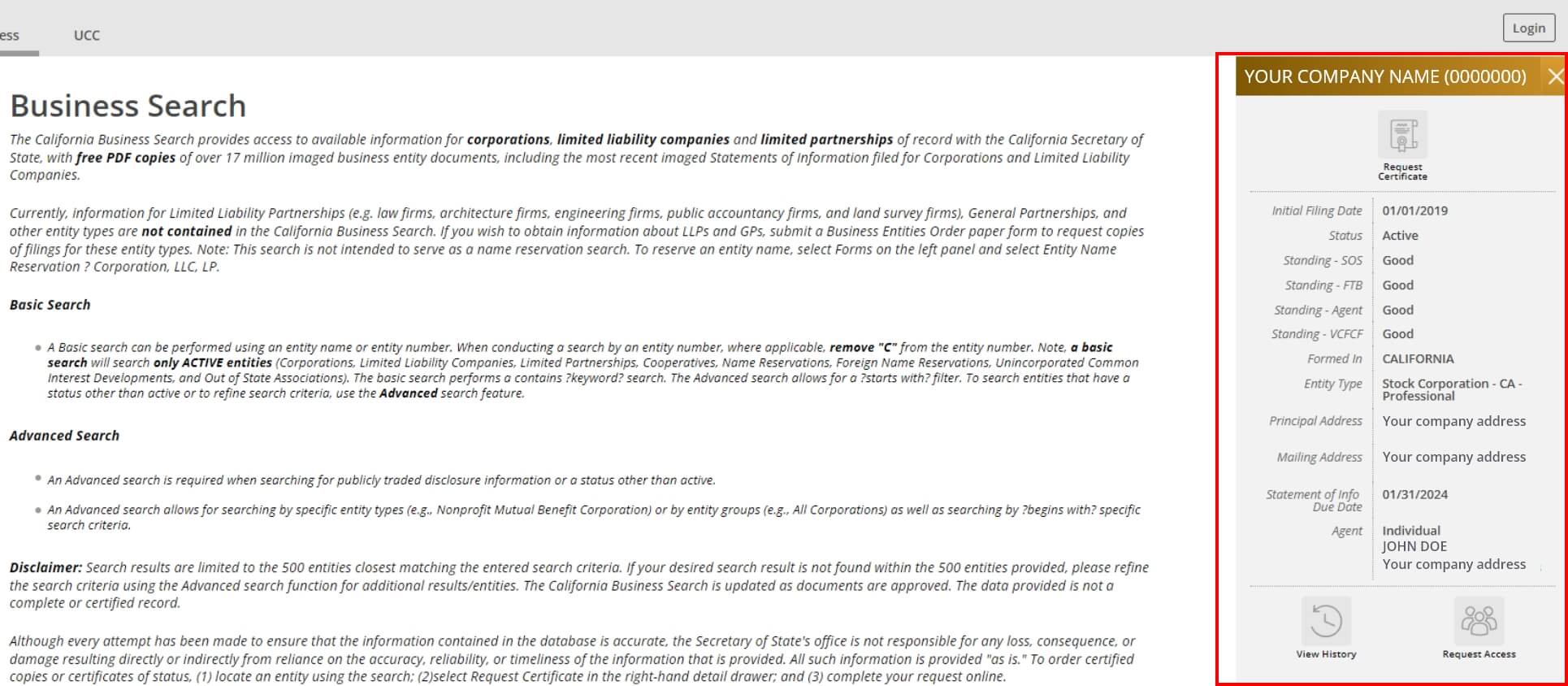

2. Save your company entity ID number

Save your company entity ID number. You can click on your company name in the search results to see more detailed information about your company. The company details will show up on the right sidebar after you click the company name.

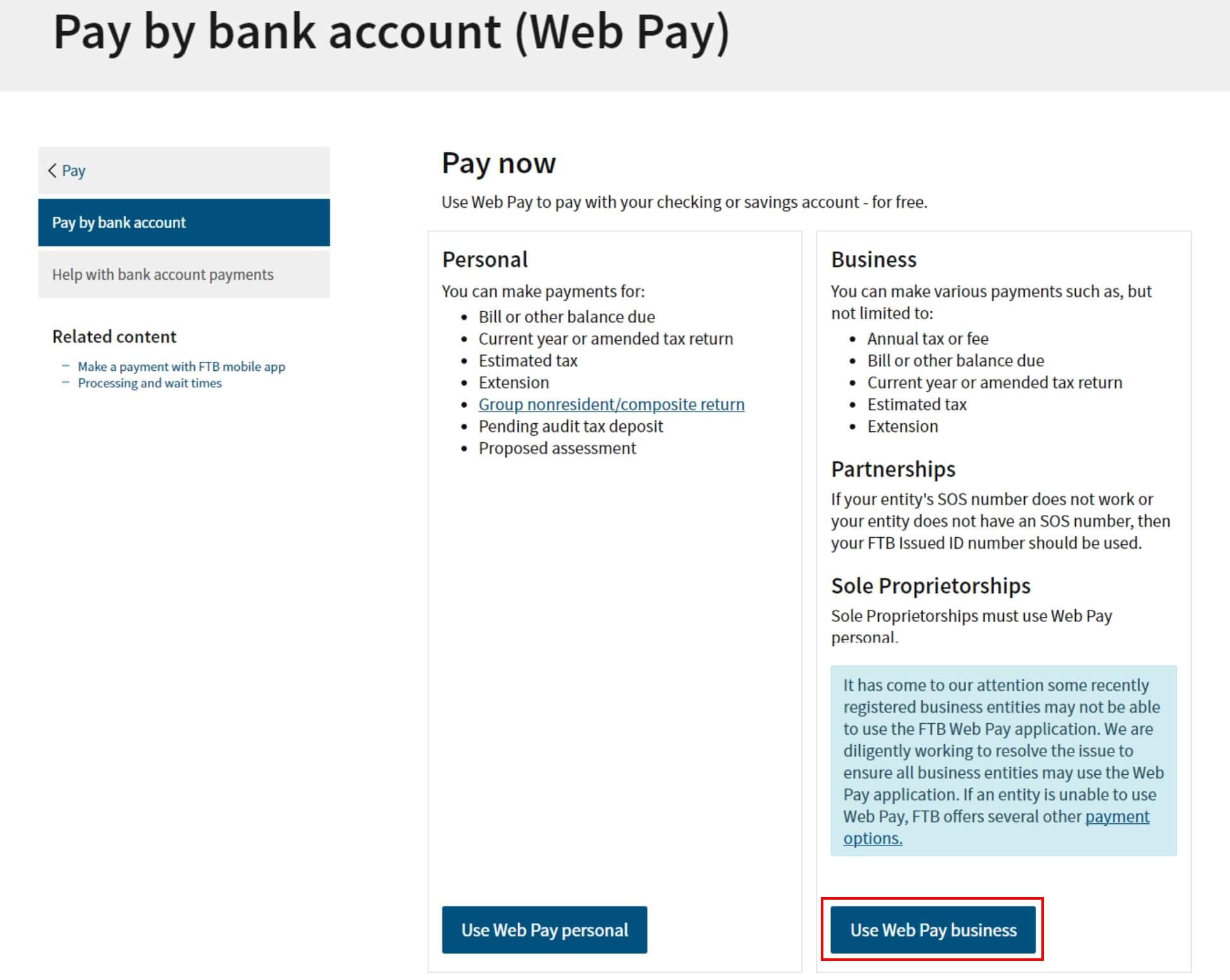

3. Go to the California Franchise Tax Board website

Go to https://www.ftb.ca.gov/

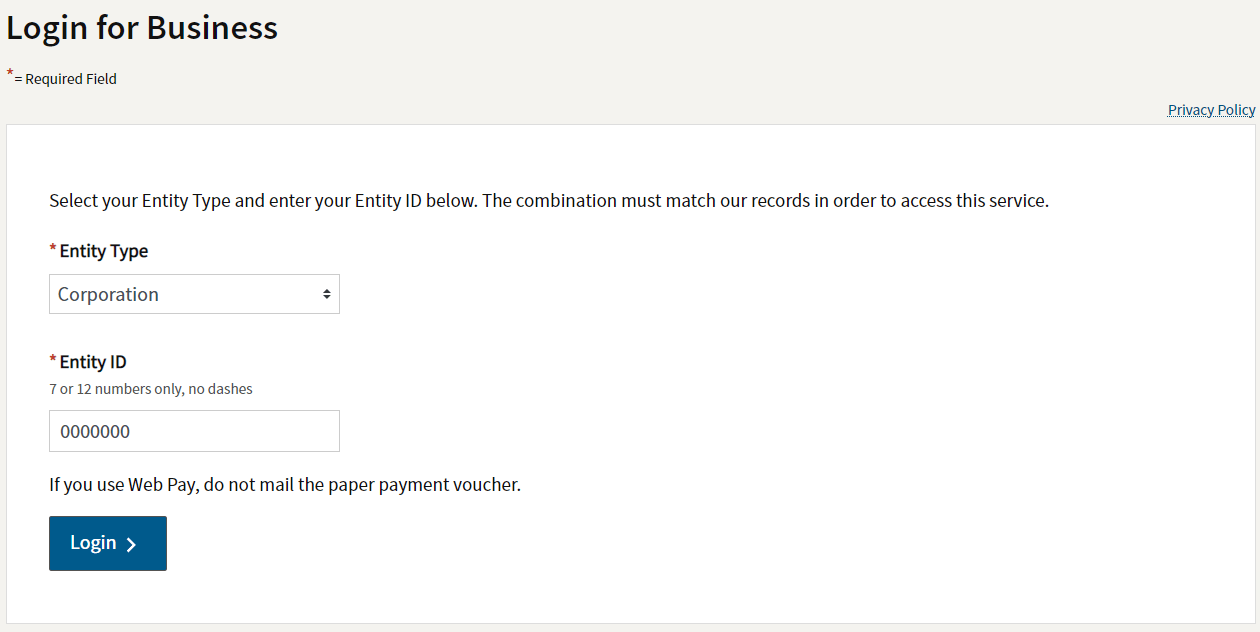

4. Fill out the form

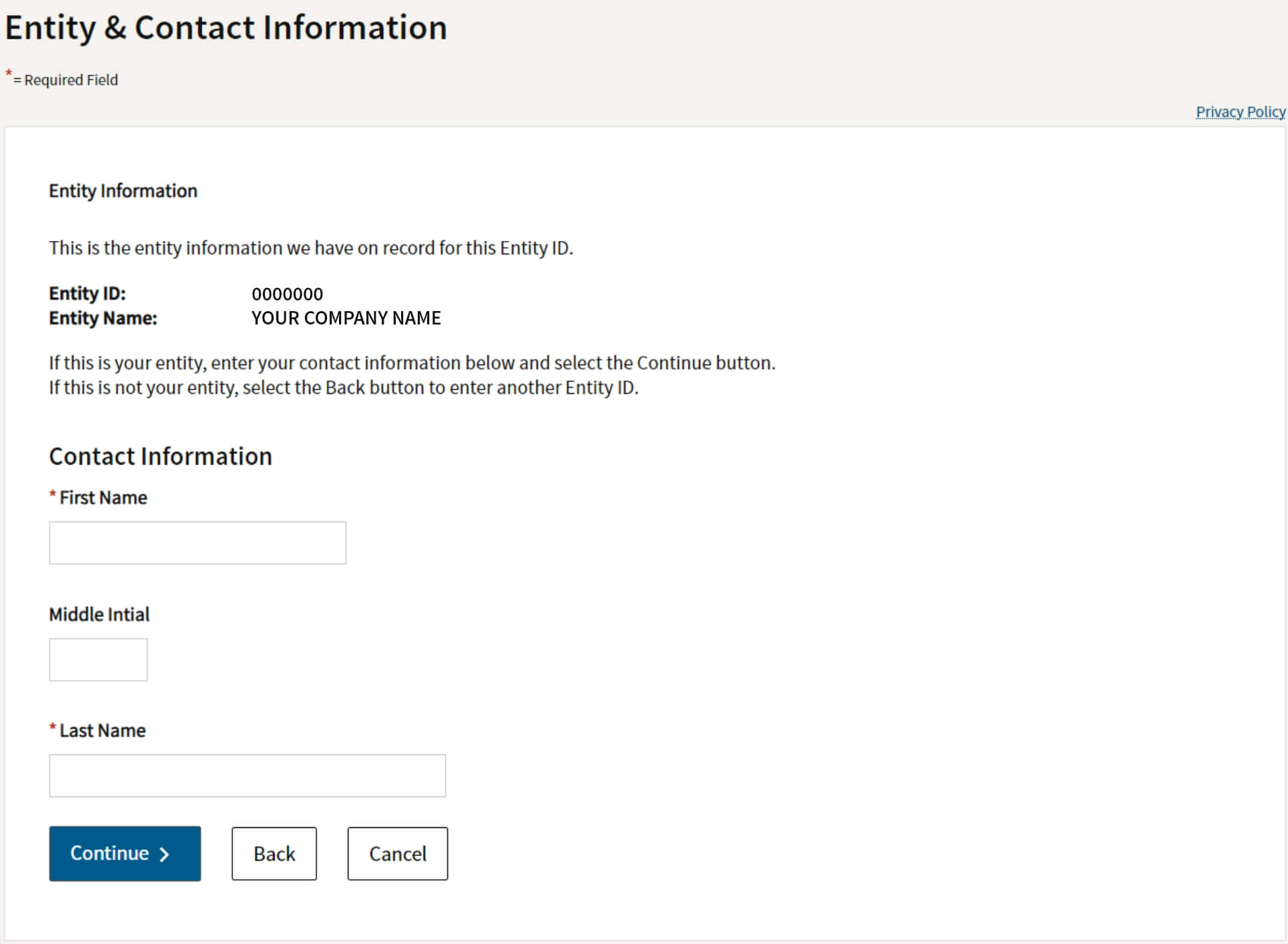

Select Corporation for the Entity Type, enter your company’s Entity ID, and then click the login button. Next, enter your contact information in the form field and click the Continue button.

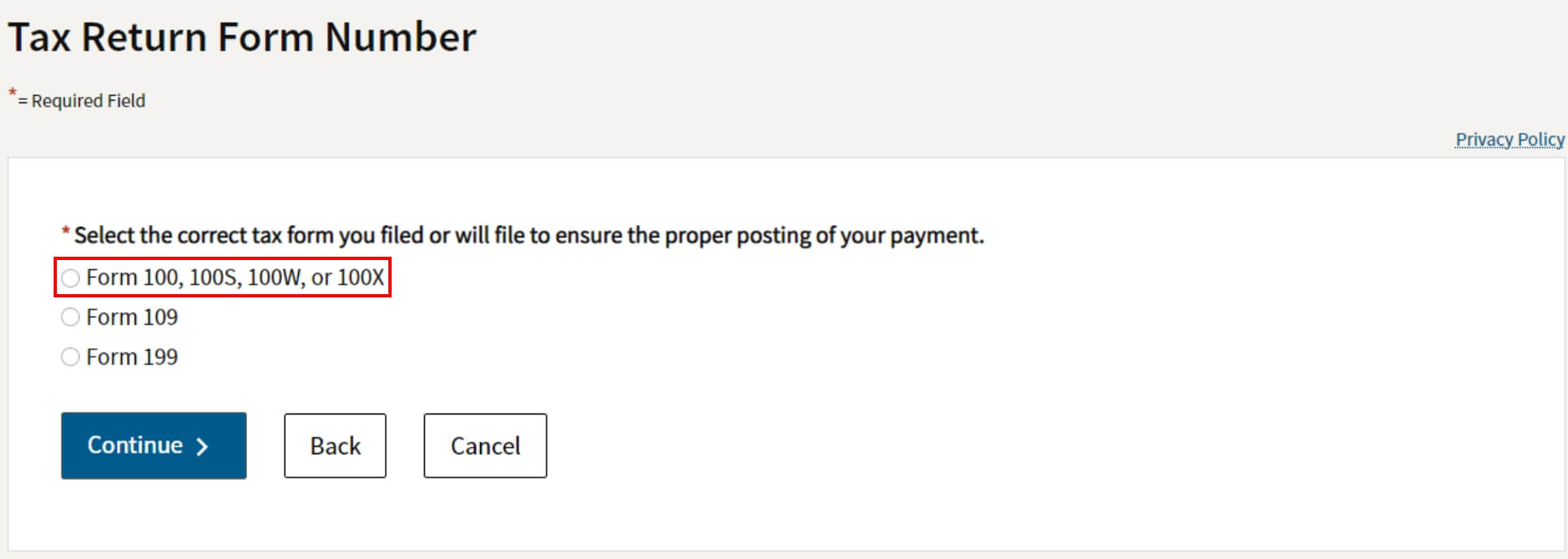

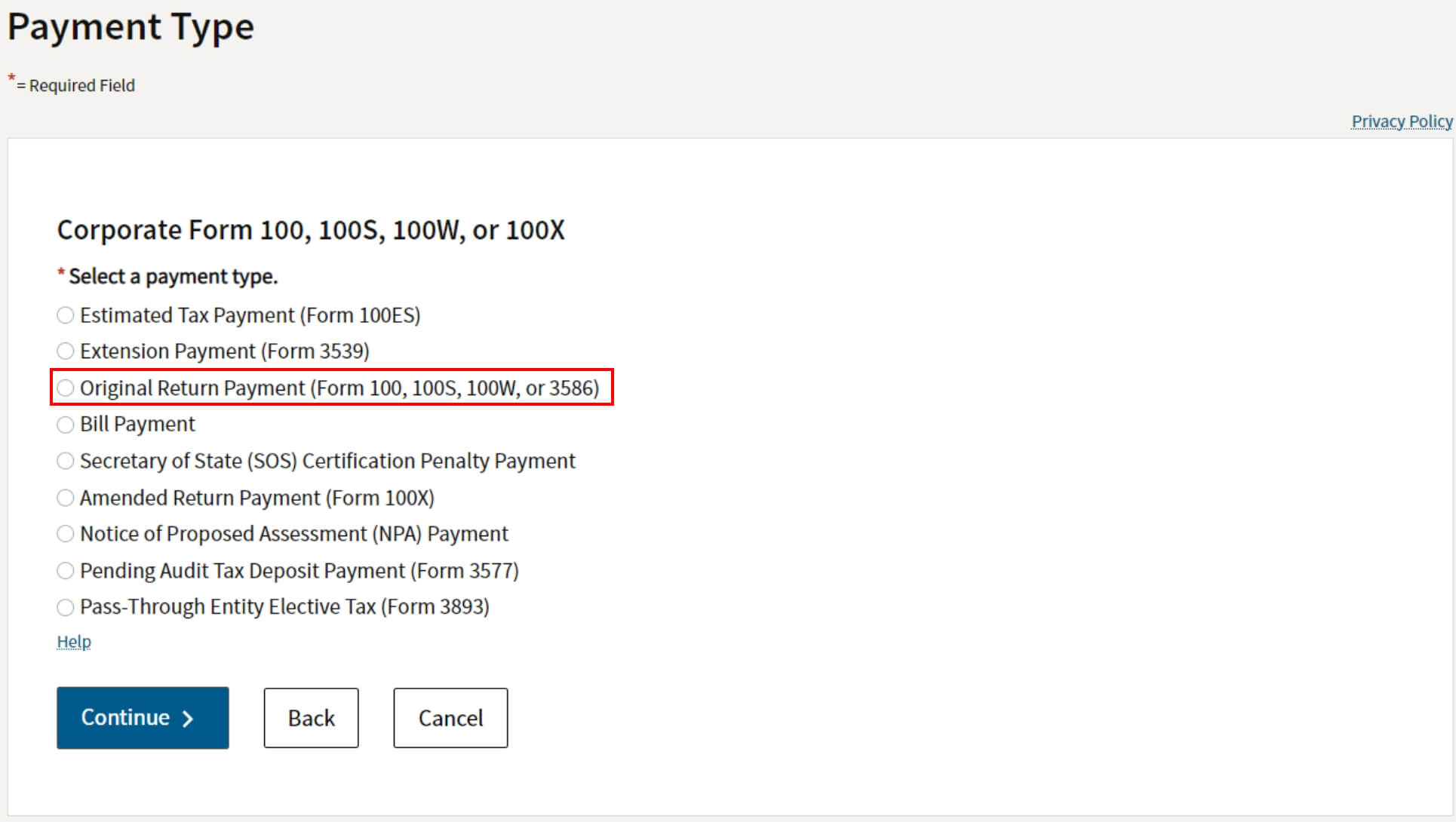

5. Tax Return Form Number and Payment Type

Select Form 100, 100S, 100W, or 100X for the Tax Return Form Number, and then select Original Return Payment (Form 100, 100s, 100W, or 3586) for the Payment Type.

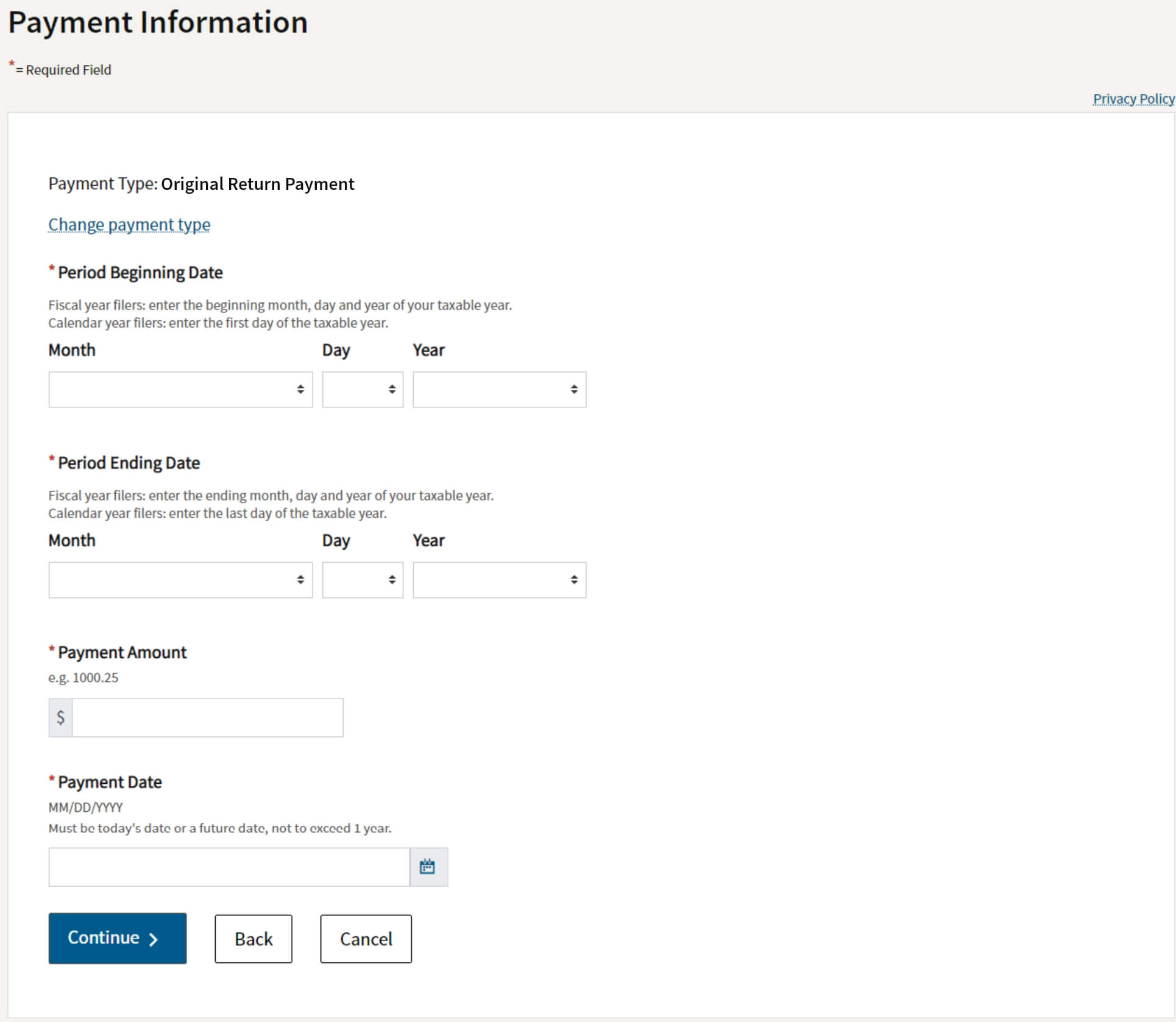

6. Fill out the rest of the form

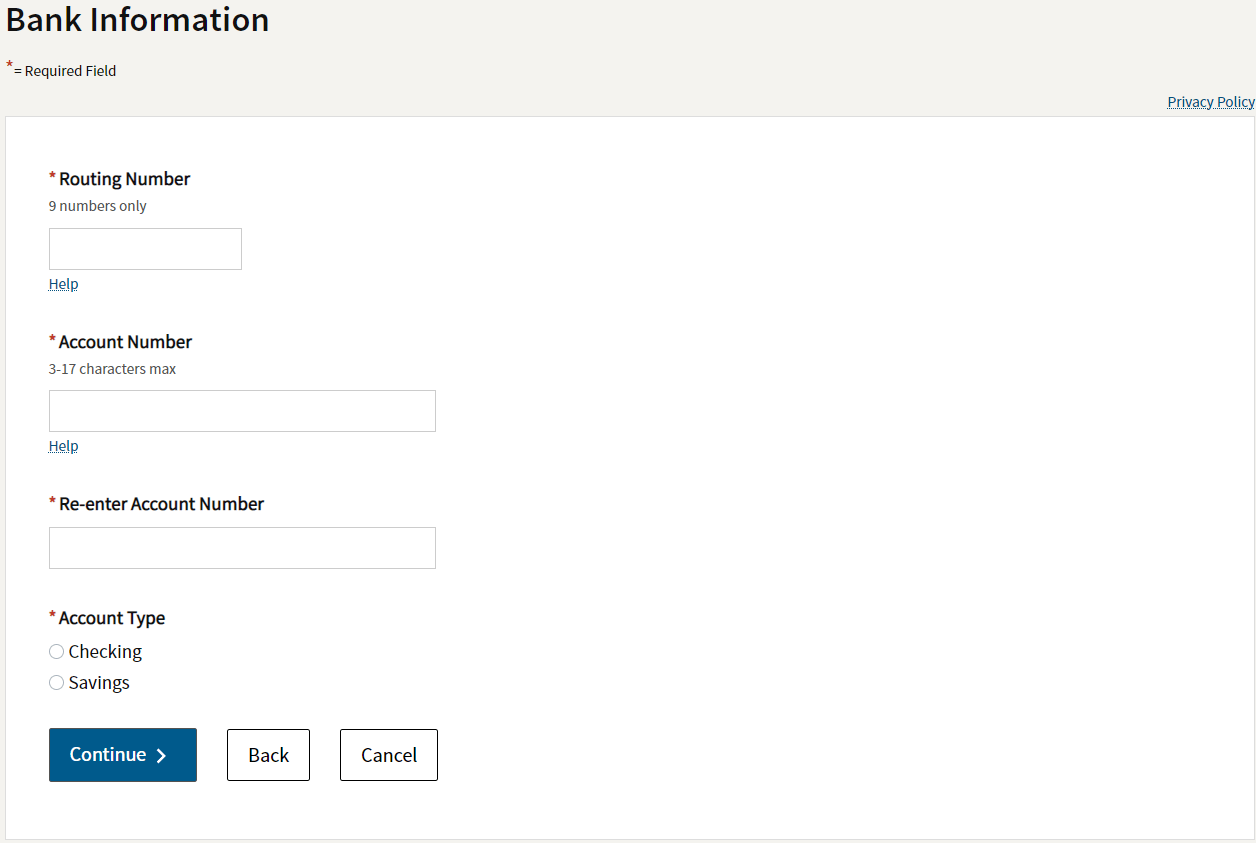

Fill out the rest of the form to include the correct payment information and bank information.

7. Print confirmation in PDF

Please ensure you print the last page of the completed form or the payment confirmation page and upload it to your shared folder. Emailed confirmations do not always contain enough information.

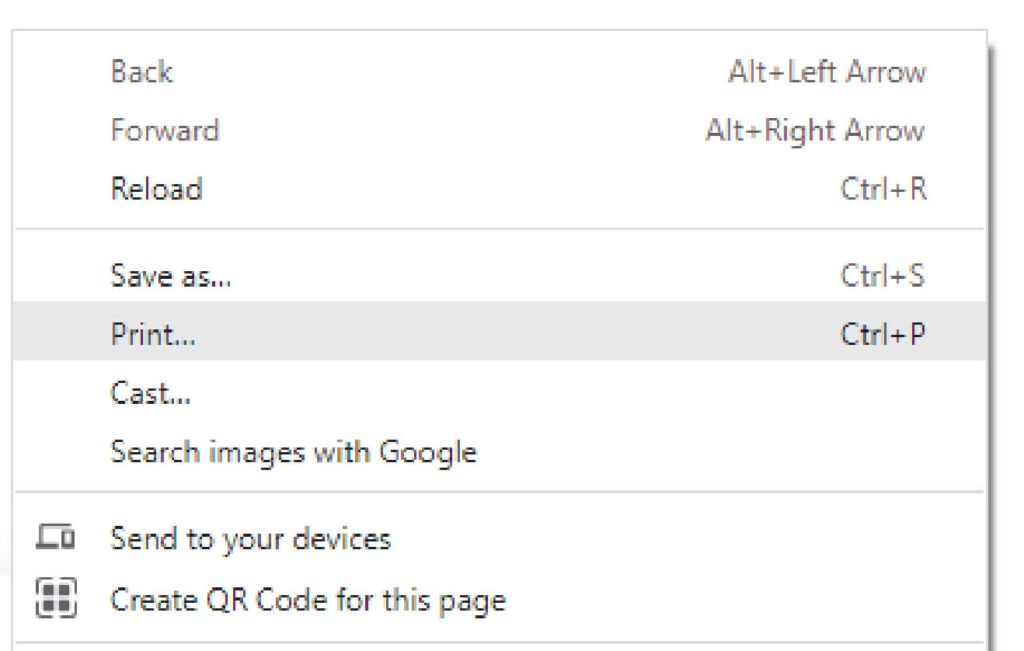

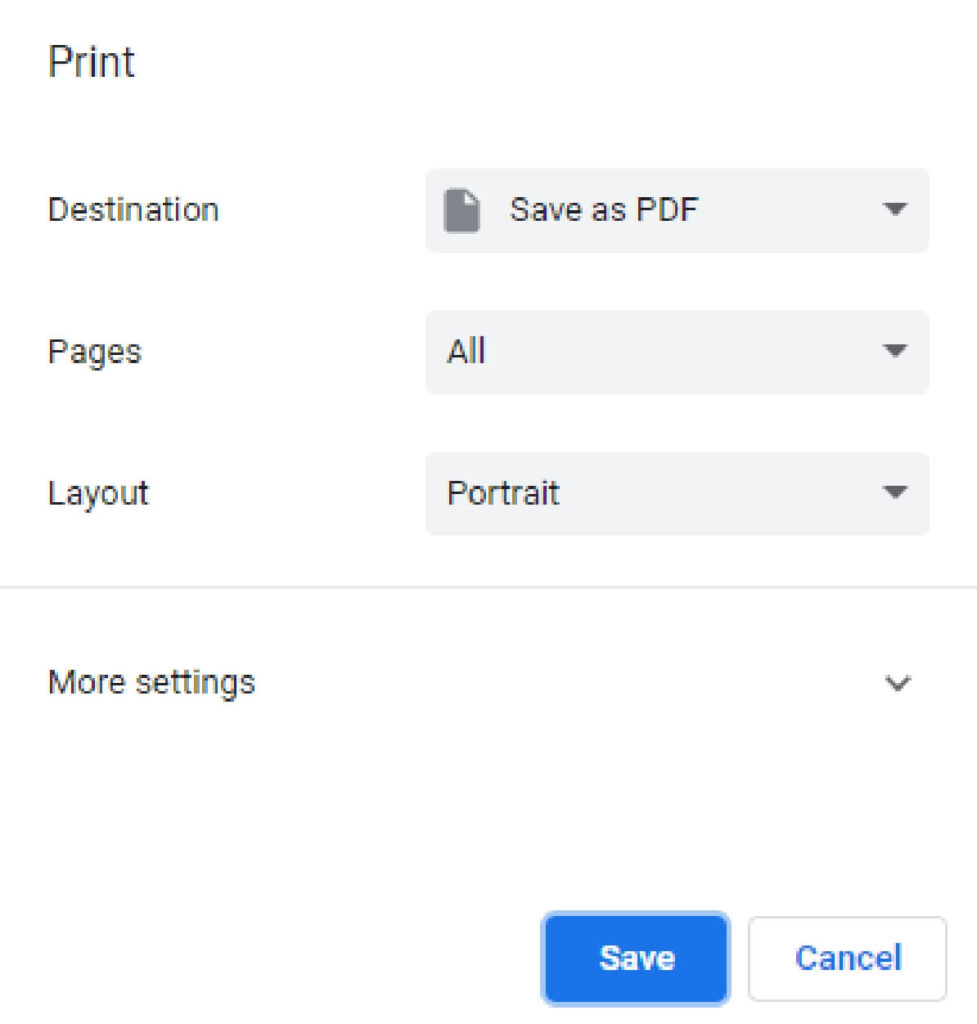

To print in PDF, right click on the confirmation page, select “Print”, and “Save as PDF”.