Individual Federal (IRS)

Completed Return

Important

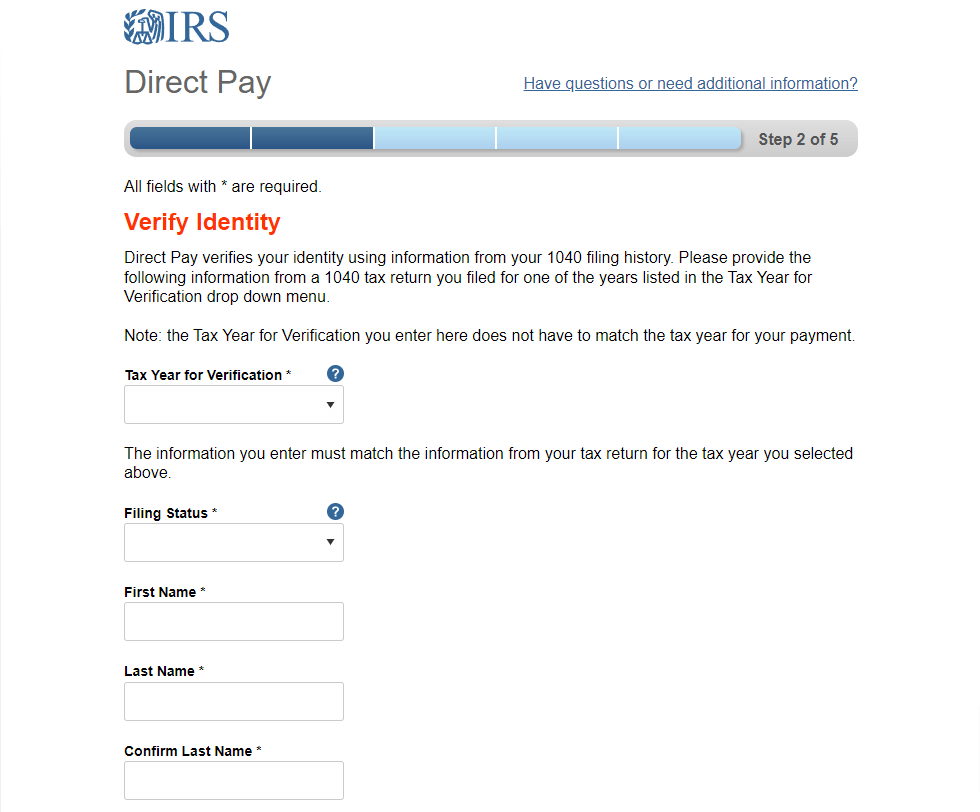

“Verify Identity” is based on the last year filed as with extension payments there is no record of the current year. Therefore use your last year filing info (Single filing or Joint) and your last year address for identity purposes.

Please ensure you print the last page of the completed form or the payment confirmation page and upload it to your shared folder. Emailed confirmations do not always contain enough information.

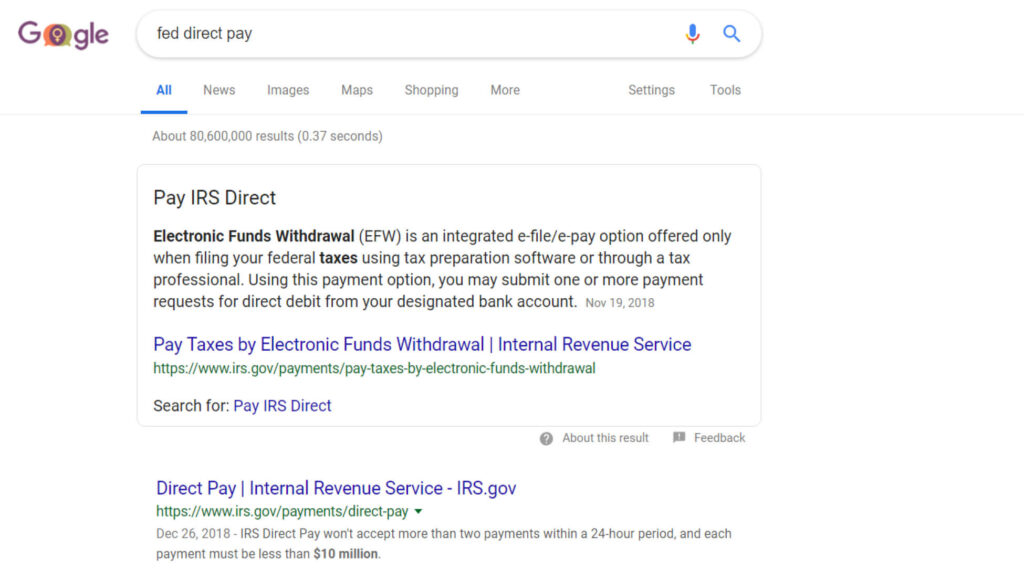

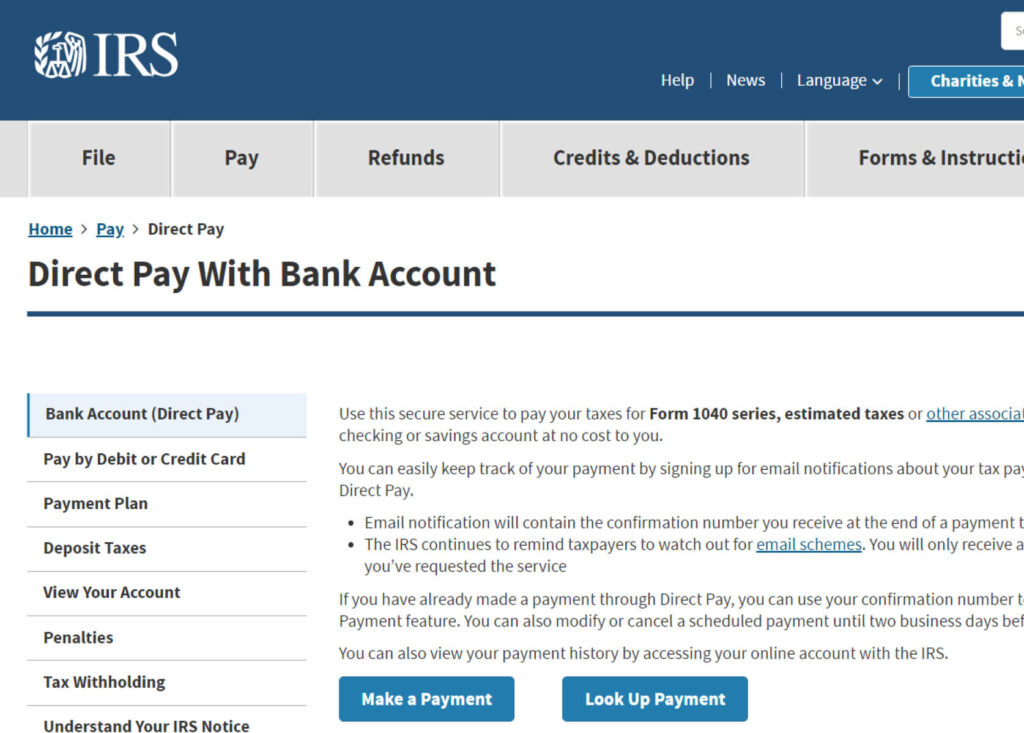

1. Go to the IRS website

You can search “fed direct pay” on Google, or just visit this link https://www.irs.gov/payments/direct-pay

2. Click "Make a Payment" button

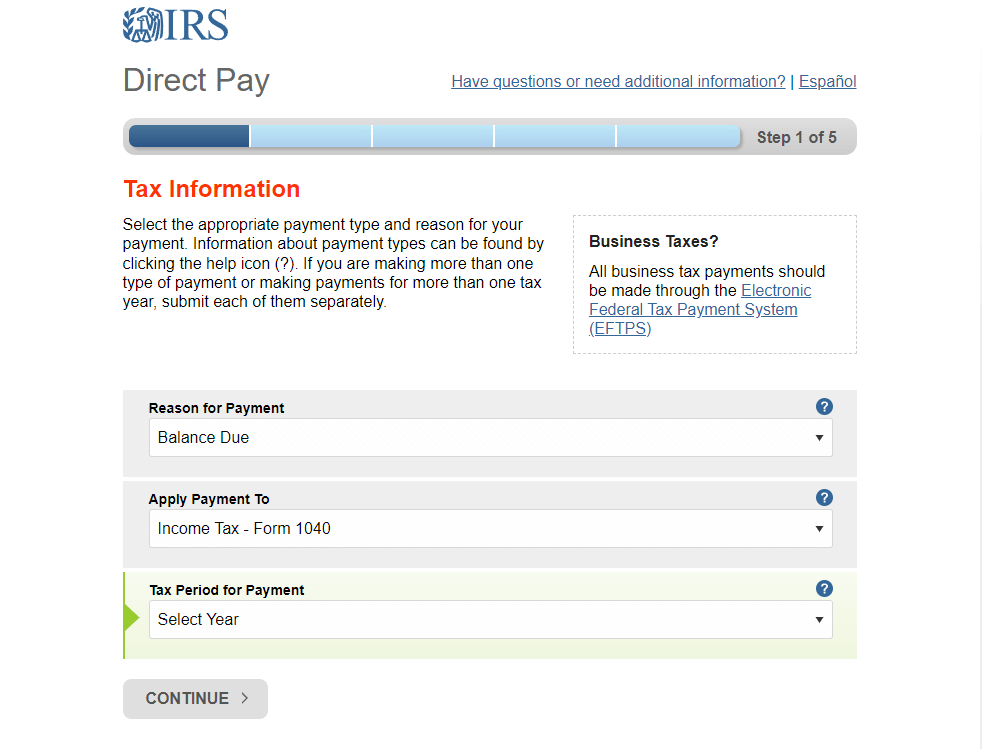

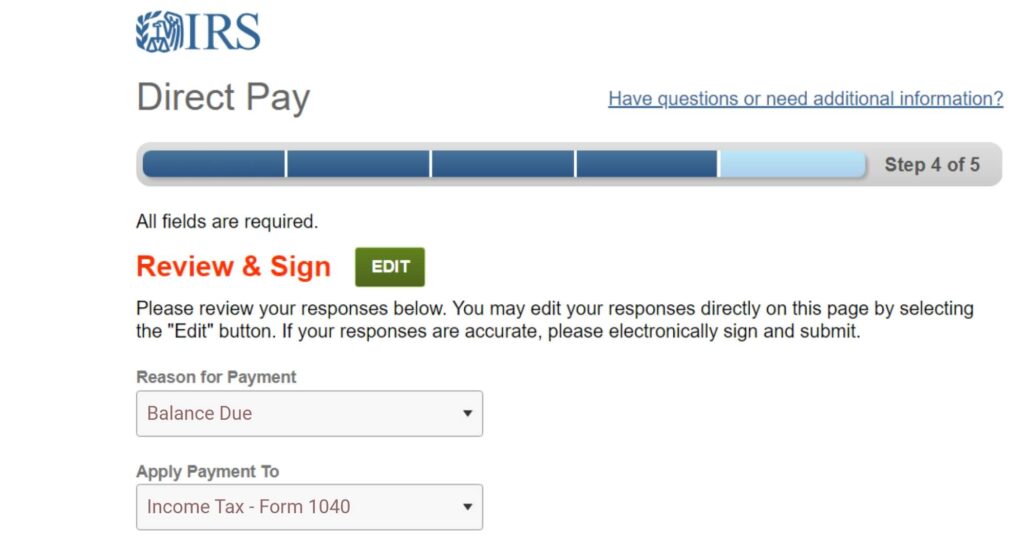

3. Fill out the form

Choose reason for payment to “Balance Due”, apply payment to “Income Tax – Form 1040”, and then select tax year, after that click continue button

4. Fill out the rest of the form

“Verify Identity” is based on the last year filed as with extension payments there is no record of the current year. Therefore use your last year filing info (Single filing or Joint) and your last year address for identity purposes.

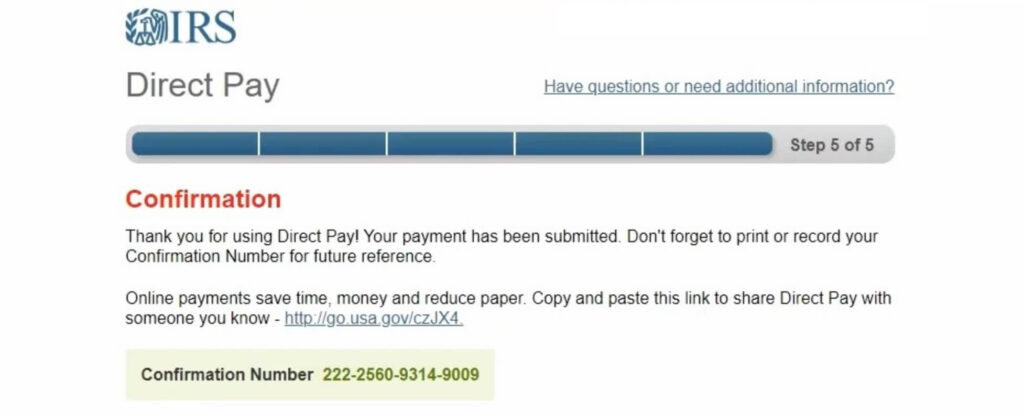

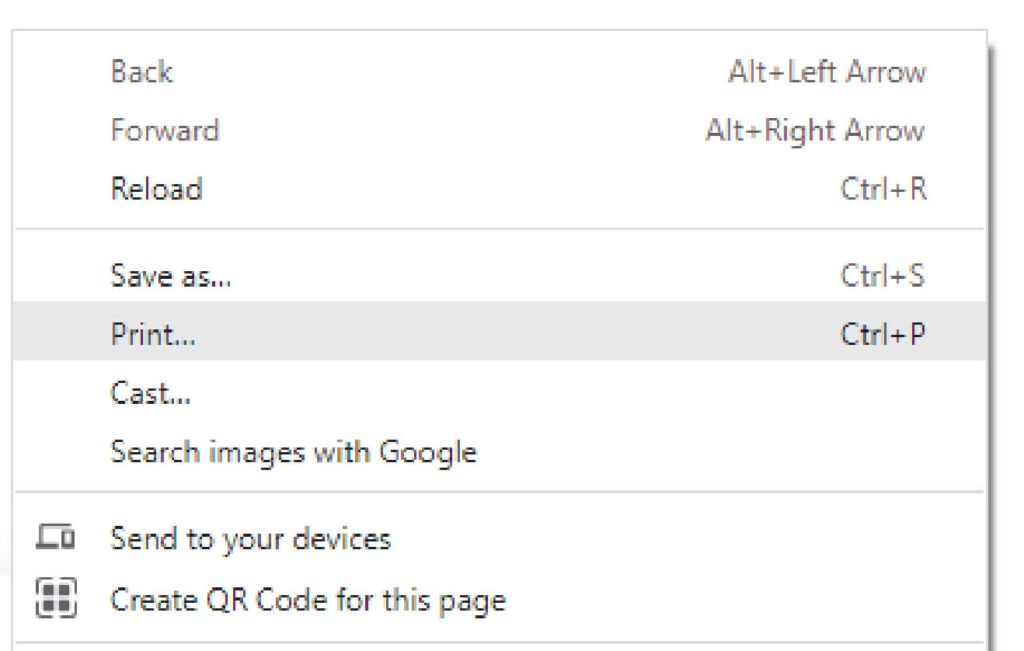

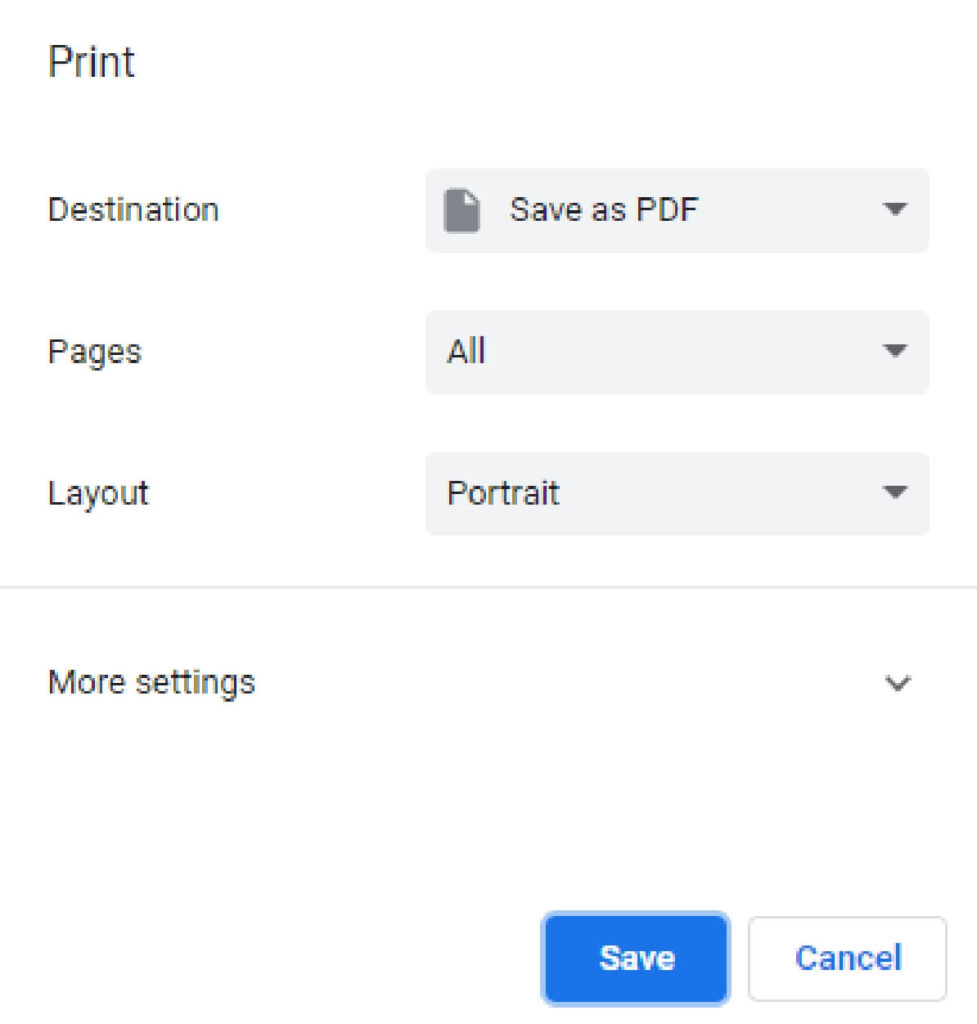

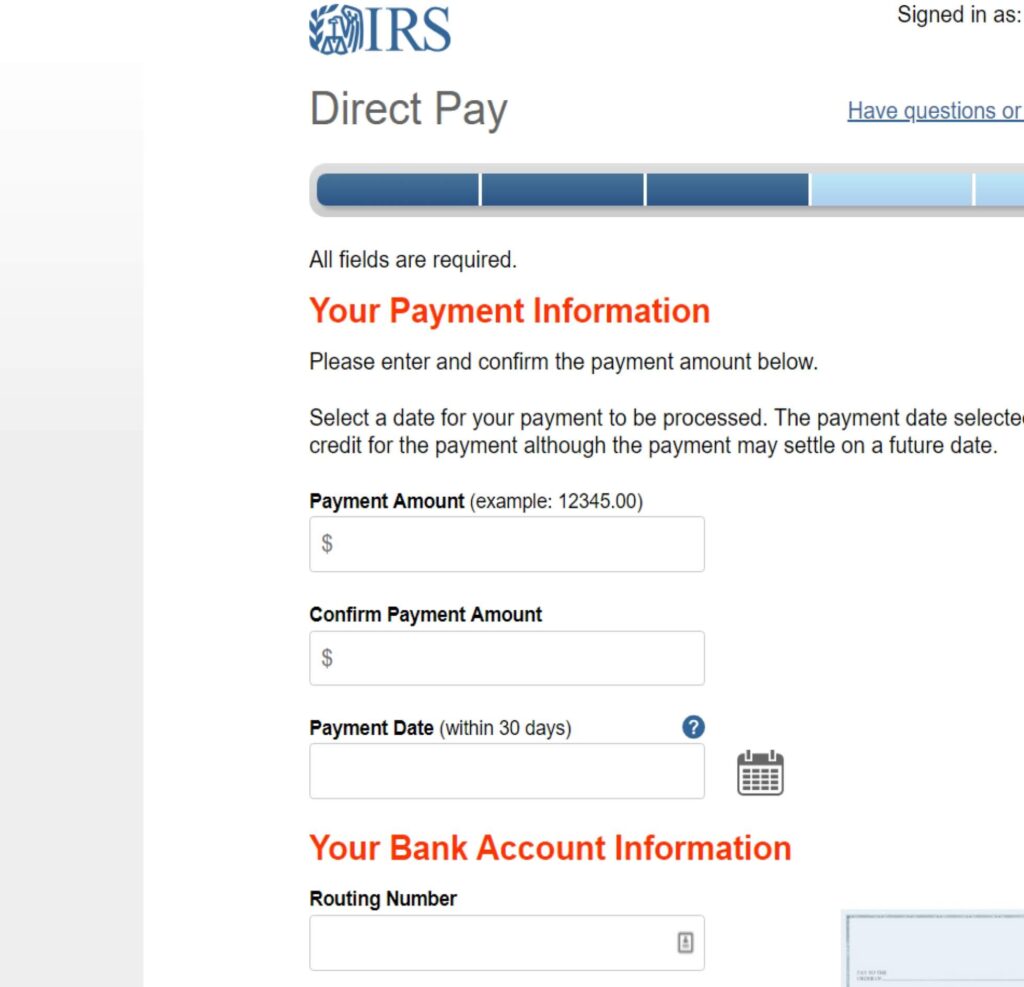

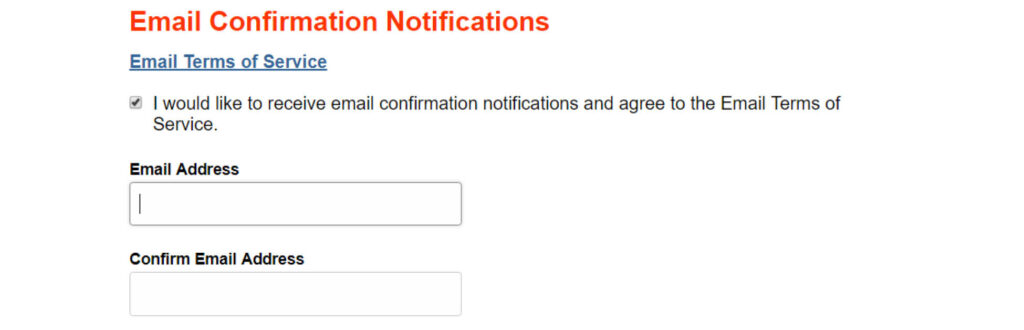

5. Print confirmation in PDF

Please ensure you print the last page of the completed form or the payment confirmation page and upload it to your shared folder. Emailed confirmations do not always contain enough information.

To print in PDF, right click on the confirmation page, select “Print”, and “Save as PDF”.